|

|

ARCHIVED CONTENT

You are viewing ARCHIVED CONTENT released online between 1 April 2010 and 24 August 2018 or content that has been selectively archived and is no longer active. Content in this archive is NOT UPDATED, and links may not function.Extract from article by Hamilton Nolan

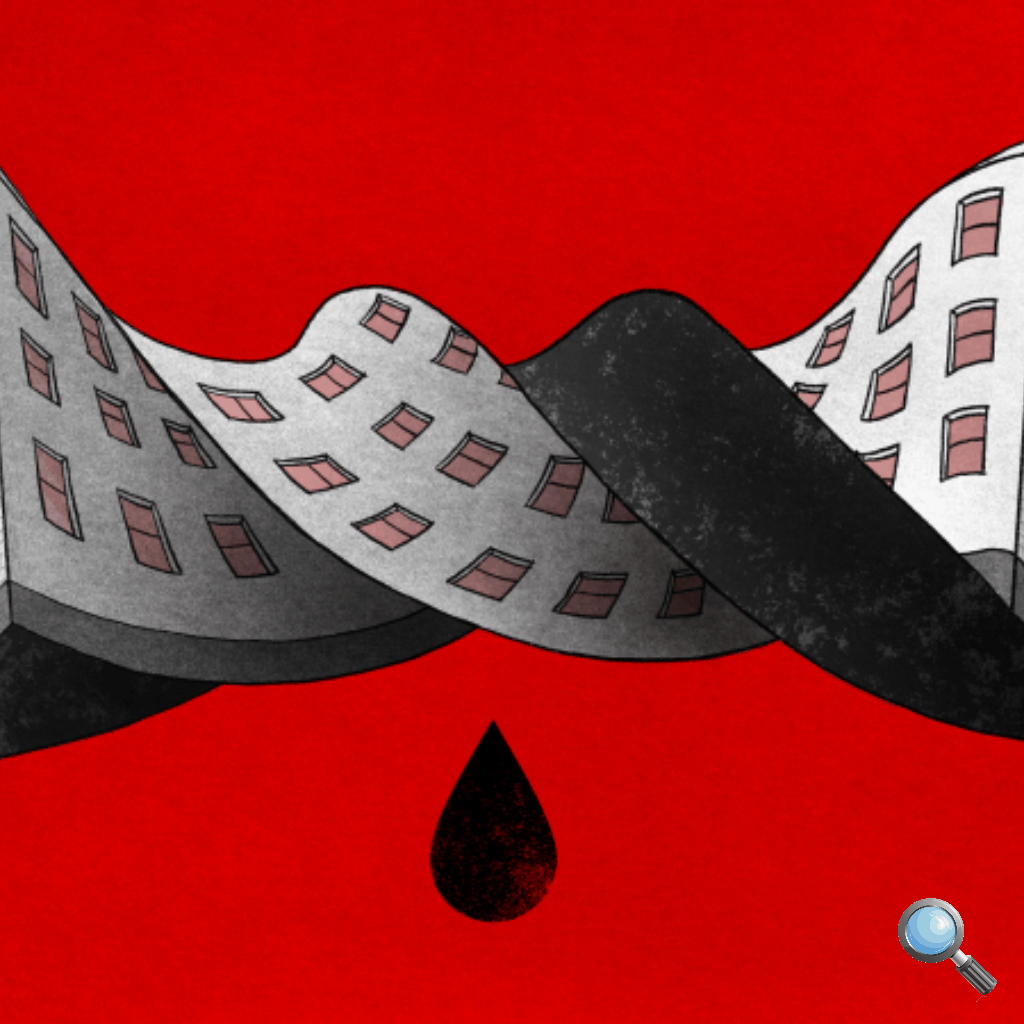

If you have seen the movie Goodfellas, you may recall the scene where the mob takes over a bar: they run up bills on the company’s credit, rob the place blind, and then, when they’ve gotten as much as they can, burn the place down and walk away. That is only a very slight exaggeration of the real business model of private equity. We turned to economist Eileen Appelbaum, co-director of the Center for Economic and Policy Research and the co-author of the book “Private Equity At Work,” for a straightforward explanation of the most vampiric of all industries.

How It Works

The kindergarten version of the private equity business model description goes like this: PE firms buy a company, fix its flaws, make it more efficient, and then sell it at a profit. That description, though, barely scratches the surface of the incredible ways that the PE industry has found to take money out of formerly independent companies.

Appelbaum is quick to note that for smaller companies—say, those with a value under a few hundred million dollars—private equity can be a useful partner. PE firms can provide those smaller, regional companies with financing when local banks aren’t available, and smaller companies tend to actually have the sorts of inefficiencies that PE firms can fix to legitimately make the company run better. But smaller companies mean smaller profits. The bulk of the PE industry’s business is done by huge firms cutting multibillion-dollar deals for big companies. And that is where the industry’s true business model comes into focus.

Read the complete article at The Working Person’s Guide to the Industry That Might Kill Your Company

Additional Reading:

- An Abridged Look at the Business of eDiscovery: A Short List of eDiscovery Investors

- An Abridged Look at the Business of eDiscovery: Mergers, Acquisitions, and Investments