Editor’s Note: The surge in fidelity crimes presents a daunting challenge for insurance companies and businesses alike. This article delves into the intricate world of combating fraud in an era marked by advanced technologies. With insightful contributions from experts in the field, including the nuanced perspectives of Peter Fogarty, Natalie Lewis, and Stephen O’Malley, the piece sheds light on the vital role of digital forensics and cross-disciplinary expertise in tackling these increasingly sophisticated crimes. Highlighting the alarming statistics from the insurance industry and emphasizing the importance of vigilance and modern security architectures, this article is a must-read for professionals in cybersecurity, information governance, and eDiscovery. It not only maps out the current landscape of fidelity crimes but also outlines the strategic defense mechanisms pivotal for safeguarding assets in this heightened digital age.

Content Assessment: Rise of Fidelity Crimes: Tackling Fraud in the Heightened Digital Age

Information - 92%

Insight - 93%

Relevance - 90%

Objectivity - 91%

Authority - 92%

92%

Excellent

A short percentage-based assessment of the qualitative benefit expressed as a percentage of positive reception of the recent article by ComplexDiscovery OÜ titled, "Rise of Fidelity Crimes: Tackling Fraud in the Heightened Digital Age."

Industry News – Cybersecurity Beat

Rise of Fidelity Crimes: Tackling Fraud in the Heightened Digital Age

ComplexDiscovery Staff

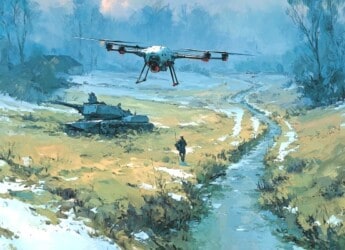

In an era where cybercrime is becoming increasingly sophisticated, the incidence of fidelity crimes has become a focal point for both insurance companies and businesses seeking to safeguard their assets. Lurking in the shadows of the digital world, fraudsters are eyeing vulnerabilities, employing schemes like phishing attacks, and exploiting poor security protocols to execute thefts and embezzlement. Among the various methodologies, the employment of advanced technologies like cryptocurrency and forensic digital tools has become paramount to both committing and investigating these fidelity crimes.

According to experts Peter Fogarty and Natalie Lewis of J.S. Held’s Economic Damages & Valuations and Stephen O’Malley, who leads Digital Investigations & Discovery, fidelity claims handling has transformed into a multifaceted discipline where digital forensics and cross-disciplinary expertise are indispensable. In particular, the interplay between modern security architecture and the auditor’s know-how can determine the success of both preventing and resolving these crimes. As O’Malley elucidates, the advent of generative AI technologies, such as ChatGPT, has impacted the manner in which fraud is both conducted and probed.

The rise in fidelity crime has not gone unnoticed; the evidence is apparent in the insurance industry’s statistics. New Hampshire, known as the Granite State, has seen a staggering 25% increase in fraud referrals in 2023, making it evident that no region is immune to such menace. The New Hampshire Insurance Department, under Commissioner D.J. Bettencourt’s stewardship, emphasizes the criticality of being vigilant against insurance fraud, noting the Coalition Against Insurance Fraud’s estimation that over $308 billion is stolen annually through these illicit means.

While these crimes take a toll on insurers’ balance sheets, the reverberations are felt by consumers, with insurance fraud estimated by the FBI to cost the average American family an additional $400 to $700 in premiums each year. Bettencourt, advocating for heightened consumer awareness, underscores the importance of identifying warning signs and verifying the authenticity of insurance policies and agents, drawing from the recommendations of the National Association of Insurance Commissioners. Conscious efforts by industries and individual vigilance are seen as the bulwark against the spread of insurance fraud.

In the labyrinth of fidelity claims, the roles of various parties intertwine in a complex dance. Policyholders grapple with the nuances of their coverage, facing potential disputes over policy terms and exclusions. Thus, cross-verification among multiple sources becomes not just a tactic but a necessity. Modern insurance protocols now entail rigorous evaluations of not only the loss but also the adequacy of internal controls and an organization’s resilience to ensure its fortified stance against future thefts. In this intricate network, insurance brokers, law enforcement, and legal counsel become key players who collectively navigate the murky waters of fidelity claims.

Fraudulent actors now stretch their tendrils across industries, asserting their presence through varied schemes from third-party theft to computer and funds transfer fraud. Entities like the OEM parts in the manufacturing industry and familiar names such as Signal, WhatsApp, and Telegram are entwined in the narrative as mediums through which fraudulent communication and transactions are orchestrated.

Complicating the scenario is the emergence of cryptocurrency, a tool that has become a double-edged sword. It is used by criminals to veil their identities and obscure the flow of illicit gains. However, it also offers investigative entities a potent resource to trace these digital footprints back to their fraudulent origins. Highlighting the significance of such expertise, O’Malley notes that a deft hand in quantifying and tracing blockchain assets can be a company’s lifeline in reclaiming stolen funds.

As the fidelity landscape continues to evolve, so too must the concerted efforts of those charged with its oversight. Bridging the gap between advanced technology and time-tested investigative procedures constitutes the cornerstone of modern fidelity claims handling. With the rise of generative AI and other emerging risks, the dynamic future of insurance demands that providers and businesses alike stay ahead of the curve, crafting a strategic defense against the specters of fraud that lie in wait.

News Sources

- Fidelity Investigations: A Guide to Successful Claims Outcomes

- Fidelity Investigations: A Comprehensive Guide to Successful Claims Outcomes (Part 2)

- How N.H. Can Combat Insurance Fraud in 2024

- Insurance in the Know (Part 1): Reservations of Rights Can Trigger Right to Independent Counsel

Assisted by GAI and LLM Technologies

Additional Reading

- Cyberattack on UnitedHealth Group Subsidiary Exposes Fragile Balance Between Healthcare and Cybersecurity

- The Cyber Siege: China’s Expanding Digital Dominance and US Response

Source: ComplexDiscovery OÜ