|

|

ARCHIVED CONTENT

You are viewing ARCHIVED CONTENT released online between 1 April 2010 and 24 August 2018 or content that has been selectively archived and is no longer active. Content in this archive is NOT UPDATED, and links may not function.

–

The eDiscovery Business Confidence Survey

The eDiscovery Business Confidence Survey is a non-scientific quarterly survey designed to provide insight into the business confidence level of individuals working in the eDiscovery ecosystem. The term ‘business’ represents the economic factors that impact the creation, delivery, and consumption of eDiscovery products and services.

Spring 2016 Survey Results

The Spring 2016 eDiscovery Business Confidence Survey was conducted between May 1 and May 31, 2016. The survey was open to legal, business, and information technology professionals operating in the eDiscovery ecosystem. Individuals were invited to participate via the ComplexDiscovery blog, via social media, and via direct email invitations. This survey had 76 respondents. While individual answers to the survey are confidential, the aggregate results are published below to highlight the business confidence level of participants in regard to the economic factors impacting the creation, delivery and consumption of eDiscovery products and services during the Spring of 2016.

N = 76 Respondents

Which of the following segments best describes your business in eDiscovery?

Part of the eDiscovery ecosystem where your organization resides.

- Software and/or Services Provider – 39.5% (30)

- Law Firm – 23.7% (18)

- Consultancy – 22.4% (17)

- Corporation – 5.3% (4)

- Media/Research Organization – 5.3% (4)

- Other – 2.6% (2)

- Governmental Entity – 1.3% (1)

How would you rate the current general business conditions for eDiscovery in your segment?

Subjective feeling of business performance when compared with business expectations.

- Good – 61.8% (47)

- Normal – 34.2% (26)

- Bad – 3.9% (3)

How do you think the business conditions will be in your segment six months from now?

Subjective feeling of business performance when compared with business expectations.

- Better – 53.9% (41)

- Same – 43.4% (33)

- Worse – 2.6% (2)

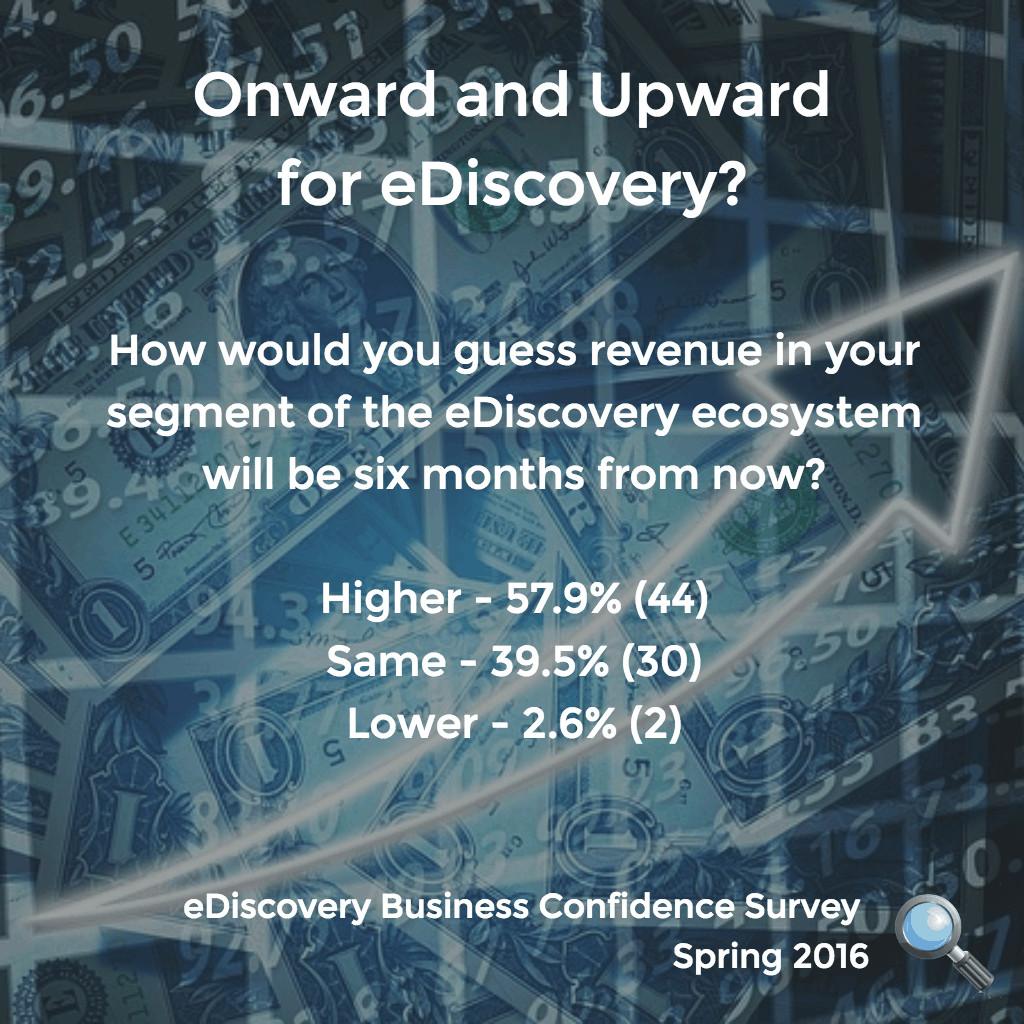

How would you guess revenue in your segment of the eDiscovery ecosystem will be six months from now?

Revenue is income generated from eDiscovery-related business activities.

- Higher – 57.9% (44)

- Same – 39.5% (30)

- Lower – 2.6% (2)

How would you guess profits in your segment of the eDiscovery ecosystem will be six months from now?

Profit is the amount of income remaining after accounting for all expenses, debts, additional revenue streams, and operating costs.

- Same – 51.3% (39)

- Higher – 39.5% (30)

- Lower – 9.2% (7)

Of the six items presented below, what is the issue that you feel will most impact the business of eDiscovery over the next six months?

Challenges that may directly impact the business performance of your organization.

- Budgetary Constraints – 28.9% (22)

- Increasing Volumes of Data – 26.3% (20)

- Data Security – 15.8% (12)

- Lack of Personnel – 13.2% (10)

- Increasing Types of Data – 10.5% (8)

- Inadequate Technology – 5.3% (4)

In which geographical region do you primarily conduct eDiscovery-related business?

The location from which you are basing your business assessments.

- North America – 90.8% (69)

- Europe – 6.6% (5)

- Asia/Asia Pacific – 2.6% (2)

- Central/South America – 0% (0)

- Middle East/Africa – 0% (0)

What are best describes your primary function in the conduct of your organization’s eDiscovery-related business?

- Legal/Litigation Support – 72.4% (55)

- Business/Business Support (All Other Business Functions) – 25% (19)

- IT/Product Development – 2.6% (2)

What are best describes your level of support in the conduct of your organization’s eDiscovery-related business?

- Executive Leadership – 55.6% (43)

- Operational Management 22.4% (17)

- Tactical Execution – 21.1% (16)

Graphical Depiction of Results and Original Survey Form

Provided below for your review and use is a graphical depiction of survey answers and a copy of the original survey form.

eDiscovery Business Confidence Survey – Spring 2016The Summer 2016 Survey

The Summer 2016 Business Confidence Survey will be open on August 1, 2016.

Source: Original Research

- Spring 2016 Survey (1 May – 31 May, 2016)

- Winter 2016 Survey (15 February – 29 February 2016)