Editor’s Note: Confidence is high in the eDiscovery and legal data sectors heading into 2026—but so is risk. This comprehensive year-end synthesis from ComplexDiscovery OÜ reveals a market that’s charging ahead with AI deployment and top-line growth, even as it stumbles in profit visibility and data security prioritization. Drawing from the firm’s 2025 research portfolio—including surveys on business confidence, market sizing, and pricing—this article surfaces a central paradox: leaders are optimistic, but the operational and financial terrain beneath them is anything but stable.

For cybersecurity, information governance, and eDiscovery professionals, this rollup is not just a retrospective—it’s a strategic overview that highlights where the industry is strong, where it’s vulnerable, and what must be addressed to truly scale. Included is full, linked access to ComplexDiscovery’s 2025 research archive, making this piece an essential reference for professionals preparing for what’s next.

Content Assessment: The 2025 Research Rollup: Unmasking the Paradox of High Confidence and Low Visibility

Information - 94%

Insight - 93%

Relevance - 95%

Objectivity - 91%

Authority - 92%

93%

Excellent

A short percentage-based assessment of the qualitative benefit expressed as a percentage of positive reception of the recent article from ComplexDiscovery OÜ titled, "The 2025 Research Rollup: Unmasking the Paradox of High Confidence and Low Visibility."

Industry Research

The 2025 Research Rollup: Unmasking the Paradox of High Confidence and Low Visibility

ComplexDiscovery Staff

The eDiscovery and legal data landscape of 2025 is defined by a jarring contradiction: industry leaders are more confident than they have been in years, yet the financial and operational ground beneath them is shifting at an unnerving pace. It is a market where optimism is high, but the margin for error has arguably never been thinner.

This paradox is the central thread running through the year’s most telling research, from the 2H 2025 eDiscovery Business Confidence Survey to the exhaustive 2024-2029 Market Size Mashup. The data paints a picture of an industry that has successfully transitioned from the tentative “pilot phase” of artificial intelligence into full-scale production, yet remains dangerously exposed to profit squeezes and security blind spots.

The Profit Squeeze Behind the Optimism

On the surface, the industry appears to be booming. The 2H 2025 Business Confidence Survey reveals that nearly 60% of legal technology professionals rate current business conditions as “good,” a stark departure from the “normal” ratings that dominated previous years. However, this bullish sentiment masks a critical divergence between revenue and actual profit. While 42% of professionals project higher revenues, a smaller segment expects those revenues to translate into higher profits.

This “profit squeeze” is exacerbated by what researchers call a “Financial Visibility Gap.” A worrying number of executives—nearly one-third—admitted they lack real-time visibility into their Days Sales Outstanding (DSO), the critical metric of how fast cash actually enters the bank. For organizations looking to survive this volatility, the immediate step is clear: audit your financial dashboards today to ensure DSO and Monthly Recurring Revenue (MRR) are tracked in real-time, not just reviewed quarterly.

The Structural Shift: Machines Over Manpower

If confidence is the mood, the 2024-2029 Market Size Mashup provides the map of where that energy is going. The market is on a trajectory to hit $25.11 billion by 2029, but the way money is spent is undergoing a fundamental reordering. For over a decade, human document review was the undisputed king of eDiscovery spending. In 2025, that dominance is eroding faster than predicted.

We are witnessing a historic crossover in which spending on software and technology is outpacing the growth of services. Review tasks, which once accounted for roughly two-thirds of every budget dollar, are shrinking to 52% of total spend. The capital is flowing upstream—toward the software that filters data before a human eye ever sees it. This shift demands that service providers pivot their value proposition immediately; those still banking solely on hourly “eyes-on-documents” revenue are standing on a melting iceberg.

The Price of Admission vs. The Price of Expertise

Nowhere is this shift more visible than in the Summer and Winter 2025 Pricing Surveys. The “engine room” of eDiscovery—data processing and hosting—has become a race to the bottom. With ingestion prices frequently dropping below $25 per gigabyte and hosting fees often dipping under $10, these services have become commodities.

However, the “front door” of the industry—forensic collections and expert analysis—tells a different story. The survey data shows that onsite forensic collections and high-level consulting are resisting this price compression, commanding premium rates that reflect the scarcity of true expertise. The market is sending a clear signal: clients will pay for defensibility and brainpower, but they will ruthlessly cut costs on storage and computing.

The AI Reality Check and the Security Blind Spot

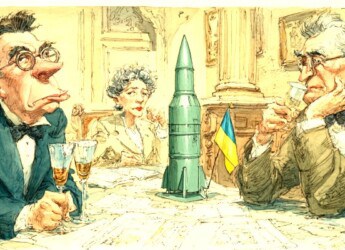

Perhaps the most startling revelation from the 2025 research roll-up is the industry’s posture toward risk. The transition to AI is no longer theoretical; 64% of respondents report they are actively integrating or deploying large language models. The days of “testing” are over.

Yet, this aggression comes with a dangerous oversight. Despite the rise of deepfakes and AI-enhanced cyber threats, “Data Security” was cited as a top business priority by only roughly 9% of respondents in the business confidence survey. This disconnect—investing heavily in AI while deprioritizing the security infrastructure to protect it—is a recipe for disaster. Organizations must realign their strategic priorities to treat security not as an IT ticket but as a C-level business imperative on par with revenue growth.

As we look toward 2026, the fundamentals are sound—revenue is climbing, AI adoption has moved from experimentation to execution, and market growth projections remain robust. But financial health and revenue growth are not the same thing. As algorithms replace billable hours and commoditization eats away at traditional margins, one question looms large for every professional in this space:

If your revenue is growing but your visibility into profit and risk is shrinking, are you actually scaling up, or are you just speeding up?

2025 Research Archive: Essential Reading

For professionals seeking to dive deeper into the data shaping these trends, the following archive provides direct access to the primary research reports released by ComplexDiscovery OÜ and EDRM throughout 2025.

Business Confidence & Operational Health

- Confidence Meets Complexity: Full Results from the 2H 2025 eDiscovery Business Confidence Survey

- Data Volumes vs. Budgets: Core Conflicts from the 2H 2025 eDiscovery Business Confidence Survey

- The Visibility Gap: Operational Metrics and Financial Health in the 2H 2025 eDiscovery Business Confidence Survey

- The Shift from AI Pilots to Production: Insights from the 2H 2025 eDiscovery Business Confidence Survey

- Steady Ground, Higher Ground: eDiscovery Business Confidence and Financial Outlooks in 2H 2025

- 1H 2025 eDiscovery Business Confidence Survey Results Released by ComplexDiscovery OÜ and EDRM

Market Sizing & Forecasting

- Complete Look: ComplexDiscovery’s 2024-2029 eDiscovery Market Size Mashup

- 2025 eDiscovery Review Update: Tasks, Cost Data, and Spending Patterns

- 2025 eDiscovery Collection Update: Tasks, Cost Data, and Spending Patterns

- 2025 eDiscovery Processing Update: Tasks, Cost Data, and Spending Patterns

- First Look: eDiscovery Market Size Mashup Highlights Growth from 2012 to 2029

- First Look: Cloud-First Trends from the 2024-2029 eDiscovery Market Size Mashup

- First Look: eDiscovery Task Allocation Trends in the 2024-2029 Market Size Mashup

- The Workstream of eDiscovery: Considering Processes and Tasks

Pricing & Valuation

- Industry Benchmarks in an Era of Transformation: The Complete Summer 2025 eDiscovery Pricing Survey

- Summer 2025 eDiscovery Pricing Trends: Setting the Stage

- The People Behind the Pricing: Respondents to the Summer 2025 eDiscovery Pricing Survey

- The Front Door of eDiscovery: Forensic Pricing Insights from the Summer 2025 eDiscovery Survey

- Processing, Hosting, and Project Management Pricing: The Engine Room of eDiscovery in the Summer 2025 Survey

- The Human Core of eDiscovery: Review Services in the Summer 2025 Pricing Survey

- Generative AI at the Frontier of eDiscovery: Pricing Insights from the Summer 2025 Survey

- ComplexDiscovery OÜ – Winter 2025 eDiscovery Pricing Report: A Market in Transition

Assisted by GAI and LLM Technologies

Additional Reading

- eDiscovery Survey Archives of ComplexDiscovery

- eDisclosure Systems Buyers Guide – Online Knowledge Base

Source: ComplexDiscovery OÜ